Shanghai Guohe Capital Rated A in Assessment of Managers of PE Funds Involving Insurance Capital in 2020

- Recent reports

-

2023-04-28

Strengthening the Fulfillment of Responsibilities, Eliminating Potential Hazards: SIG Conducts Safety Inspection before "May Day" Holiday

Learn more

-

2023-04-27

Nearly 100 Invested Enterprises of SSC Selected into Global Unicorn Index 2023

Learn more

-

2023-04-26

Seizing Opportunity, Recording Lowest Coupon Rate, Enhancing Market Visibility: SSAM Successfully Issues First-Tranche MTNs in 2023

Learn more

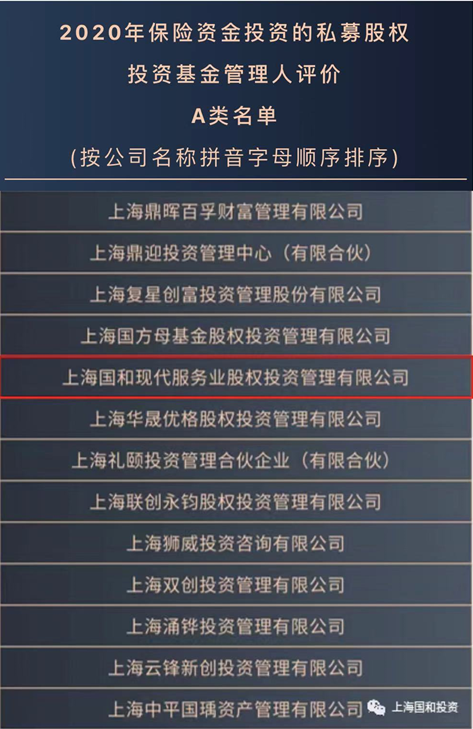

On November 16, 2020, the Insurance Asset Management Association of China organized industrial forces to assess managers of 143 private equity (PE) funds from the perspective of insurance institution investors in accordance with the regulatory requirements and rules of self-regulation. Shanghai Guohe Capital achieved the top rating-A.

With regulatory policies, rules and regulations of PE funds involving insurance capital as the main basis, the assessment was conducted according to practical needs of the industry. The assessment system consists of 9 first-level indictors (corporate governance and investment team, management system and process, risk management, scale and performance, post-investment management mechanism, lawful and compliance operation, insurance cooperation, incentive and constraint, information reporting and disclosure) and 50 second-level indictors.

Insurance capital can revitalize the real economy through equity investment in the context of de-leveraging and industrial integration, which has become an important source of Shanghai Guohe Capital's equity funds. In the future, the company will stay focused on industrial upgrading and technology innovation, and make unremitting efforts to persistently create higher value for investors and the society.