Achieving New Success in Bond Issuance, Advancing High-quality Development: SIG Successfully Issues First-tranche MTNs in 2022

- Recent reports

-

2023-04-28

Strengthening the Fulfillment of Responsibilities, Eliminating Potential Hazards: SIG Conducts Safety Inspection before "May Day" Holiday

Learn more

-

2023-04-27

Nearly 100 Invested Enterprises of SSC Selected into Global Unicorn Index 2023

Learn more

-

2023-04-26

Seizing Opportunity, Recording Lowest Coupon Rate, Enhancing Market Visibility: SSAM Successfully Issues First-Tranche MTNs in 2023

Learn more

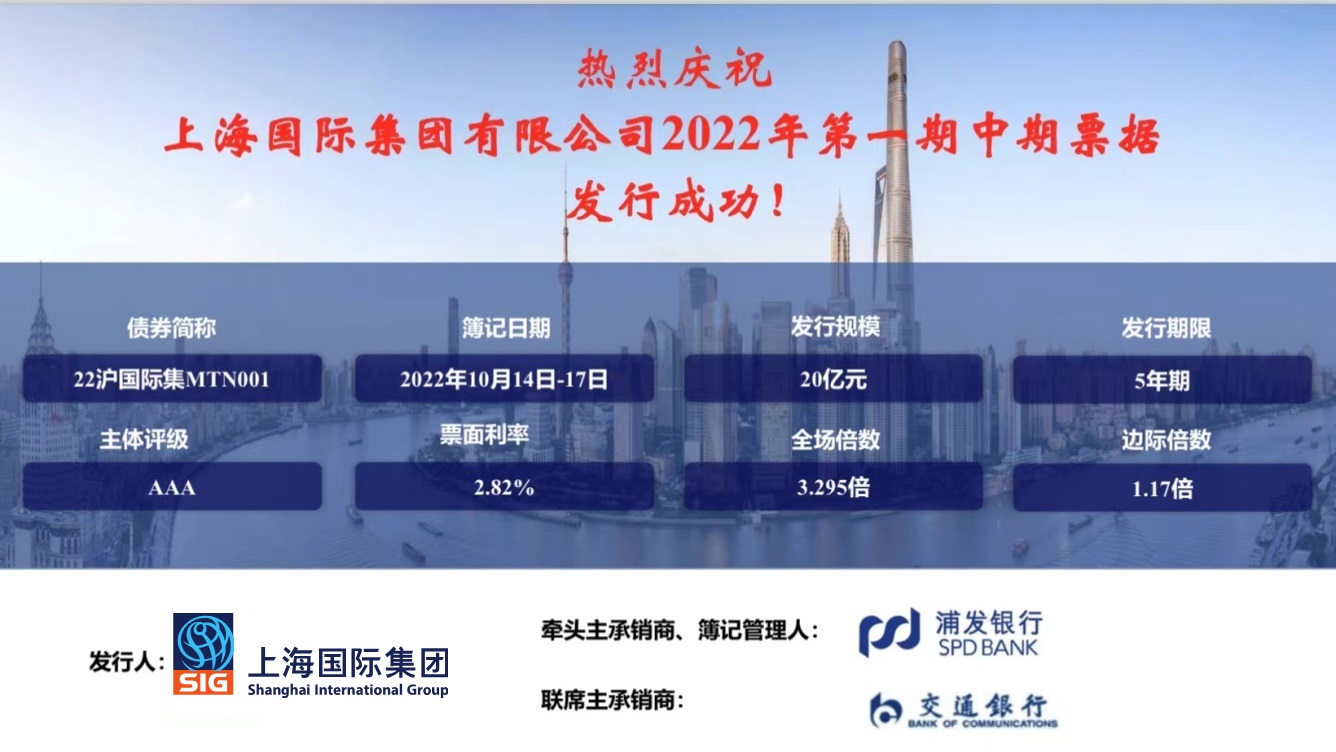

On October 17, SIG successfully issued its first-tranche medium-term notes (MTNs) in 2022, with a scale of 2 billion yuan, a term of 5 years and a coupon rate of 2.82%, registering 10 base points lower than the five-year yield of ChinaBond Short and Medium-Term Notes in the day of issuance and 148 base points lower than the LPR in the same period.

With a subscription ratio of 3.295, a marginal subscription ratio of 1.17 and a coupon rate of 3.82%, this tranche of MTNs was book-kept and issued from October 14 to 17. About 30 investment institutions, including banks, securities companies and fund companies, made subscriptions. The raised capital will be used to redeem the principal for the put-back of the first-tranche bonds issued by SIG's headquarters in 2019 to contribute to industrial investment funds. Through the issuance of this tranche of MTNs, SIG's headquarters have realized the seamless arrangement of funds for redemption, further reduced financing costs and optimized the asset-liability matching.

On the new journey, in the new era, SIG will continue to strengthen capital and financing management, improve the lean, intensive and intelligent level of fund management, strictly prevent debt risks, keep improving its capacity for financial support, endeavor to reduce financing costs, and further promote the all-round and high-quality development of SIG, thereby making new and greater contributions to building Shanghai into "five centers" and deepening the reform of state capital and state-owned enterprises.